Apply for Your Ohio Tax ID Easily with GovDocFiling

Get your Ohio tax ID easily and stress-free. GovDocFiling helps you through the EIN application, so you’re set up quickly.

Our guide covers everything you need to know to get your Ohio tax ID.

What is a Tax ID?

A tax ID (Taxpayer Identification Number) is a distinct number assigned to you by the government to track your or your company’s finances for tax reporting purposes. As such, there are different types of tax IDs for individuals and businesses, but our focus is on EIN.

An employer identification number is needed to manage crucial business operations. It’s necessary for reporting income, filing taxes, and opening a business bank account. You may even need it to secure business funding and get business licenses and permits.

What are the Different Types of Tax IDs?

We’ll be focusing mainly on the EIN, but it’s important to understand the various types of tax IDs as well. It will help you learn the difference. Let’s go through the most common types of tax IDs and their purposes:

Employer Identification Number

The EIN, also called a Federal Tax ID, is used to identify your business for tax purposes. You need an EIN for LLC, S-corp, C-corp, sole proprietorship and partnership. You’ll also need it to hire employees, get licenses, file taxes, and open a new business bank account.

Social Security Number

The social security number is the most common Tax ID for individuals. It’s issued to U.S citizens and certain permanent residents for tracking wages and personal taxes. However, sole proprietors can use their SSN to file business taxes instead of getting separate tax IDs.

Individual Taxpayer Identification Number

An ITIN is assigned to individuals who don’t qualify for an SSN but need to file taxes in the U.S. It’s issued to nonresidents, foreign investors, and dependents. An ITIN doesn’t provide work authorization or Social Security benefits — it simply tracks tax obligations.

State Taxpayer Identification Number

In addition to your federal tax ID, some states, like Ohio, issue their own state tax IDs. You’ll need one to handle state-level taxes such as sales tax, payroll tax, or income tax. The requirements vary by state, so check the rules that specifically apply to Ohio.

Why Apply for a Tax ID: Key Benefits

Getting a federal tax ID in Ohio is essential, whether you’re running an entertainment company, consulting business, or freelance venture.Here’s why you should apply for a tax ID.

Streamlines Tax Filing

The IRS requires business entities, such as partnerships, S-Corps, LLCs, and C-Corps, to file applicable taxes. With a tax ID, reporting taxes becomes easier. Instead of using your Social Security Number for business tax returns, you use the EIN.

The number helps both the IRS and the Ohio Department of Taxation identify your business for tax filing. This ensures your filings are correctly processed and reduces the risk of errors or delays. It also lets you handle your business taxes professionally.

Enables Employee Hiring

You can’t legally hire employees without an Ohio tax ID. But once you get it, you can hire staff. It enables you to register for state and federal payroll taxes, withhold the correct income taxes, and pay Social Security and Medicare contributions.

An Ohio tax ID also ensures you’re compliant with the Ohio Department of Job and Family Services for unemployment insurance and workers’ compensation. This step protects both you and your employees while keeping you in line with labor laws.

Legitimizes Your Business

Having an Ohio tax ID signals that your business is officially registered with the state of Ohio. This is especially important when negotiating with vendors and suppliers or partnering with larger companies that require verified credentials.

An EIN or tax ID also helps you build trust with your customers. They are more likely to buy from you when they know they’re dealing with a real, accountable business. Plus, you’ll need to show credibility to acquire various business licenses and permits.

Shields Personal Information

Without an Ohio tax ID, you might be forced to use your Social Security Number on invoices, legal documents, and vendor contracts, placing your personal identity at risk. Using an Ohio tax ID in place of your SSN helps prevent identity theft and fraud.

It allows you to conduct business in the state of Ohio without exposing your personal data to every customer, supplier, or third party you deal with. Having a separate tax ID also helps you separate your business finances from your personal finances.

Why Should You Outsource Your Ohio Tax ID Application?

Applying for an Ohio tax ID involves strict requirements and completing lengthy forms, that many entrepreneurs find overwhelming.Here’s why you should outsource your Ohio tax ID application to experts.

Quick Filing

Applying for an Ohio tax ID can be confusing. Professionals who specialize in tax ID applications are familiar with the forms, so they can help you get your ID quickly and without stress.

Accurate Processing

It’s easy to miss a step or choose the wrong options, which can cause your application to be rejected. An experienced online business incorporation service ensures your forms are accurate.

Compliance Support

Tax laws are constantly changing, and staying up-to-date can be challenging. Reliable business formation experts ensure your Ohio tax ID application remains compliant.

Responsive Support

You don’t have to spend hours searching online for answers. Most professional filing services offer dedicated and responsive customer support to walk you through your concerns and next steps.

Expert Guidance

You may struggle to understand which type of tax ID you need and why. A professional can answer your questions and guide you through the process. This helps you make the right business decisions.

Confidential Handling

Protecting your privacy is a top priority. Outsourcing to professional filing services helps protect your Ohio tax ID application, ensuring your sensitive information remains confidential during the process.

How To Apply for an Ohio Tax ID

Filing for an Ohio tax ID involves a series of steps and legal requirements that can be confusing for new business owners.

We’ll walk you through the process, so you don’t miss anything:

Confirm Your Eligibility

You’ll need an Ohio tax ID if you operate a business and have or plan to hire employees. Before applying, confirm that you meet the requirements. You must file for an Ohio tax ID if you sell taxable goods/services or file business taxes in Ohio.

Legal entities like sole proprietorships, corporations, LLCs, partnerships, nonprofits, estates, and trusts are all legally required to obtain and use a valid tax ID. Still, check the specific requirements for your business and see if you need one.

Prepare Required Information

Having all the forms and legal paperwork in one place makes the Ohio tax ID application process smoother and faster. You’ll require your legal business name and trade name (if you have one), and type of business structure (LLC, C-corp, etc.).

Ensure you have your business’s start date, nature of activities, projected monthly sales, and other relevant information before you start your EIN application. You’ll also need the responsible party’s full name, SSN/ITIN, and contact info.

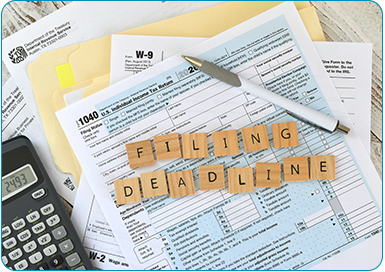

Select Your Filing Method

You can apply for an Ohio tax ID using several methods, depending on your preferences and location. Applications can be submitted online, by mail, or fax. Phone applications are also available, but are only for international applicants.

Filing for an Ohio tax ID online is the fastest option and also the most convenient one. Other tax ID filing methods take longer to process. Phone applications are quick, but are for international applicants only, so online filing is your best option.

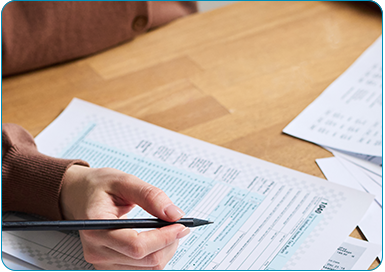

Complete Your Tax ID Application

Carefully complete the online or paper application. If you’re applying for your Ohio tax ID online, fill out the IRS Form SS-4. Ensure that all the information provided on the form is accurate and consistent with your other legal documents.

Ensure you review the entire form thoroughly, as inconsistent information can cause delays, additional verification steps, or outright rejection of your tax ID application. Once you’ve reviewed everything, you can proceed to the next step.

Submit Your Ohio Tax ID Application

Once you have completed the Ohio tax ID application and attached any required documents, submit it using your preferred method. If you’re submitting your forms online, you’ll receive your tax ID much faster, usually within minutes or a few hours.

If you apply for your Ohio tax ID by mail or fax, ensure you send your documents to the correct IRS address. International applicants are to provide their details over the phone. These steps ensure your application gets processed without delays.

Secure and Use Your Tax ID

After your Ohio tax ID is approved, you can finally use it to open a business bank account, apply for business licenses or permits, file tax returns, and hire employees. Keep the tax ID in a secure location where only authorized individuals can access it.

For additional security, store a digital copy of your Ohio tax ID confirmation letter in an encrypted or password-protected folder, along with your important business documents. You can use this for future reference, if you ever need it.

Why Choose GovDocFiling To File Your Ohio Tax ID?

Partnering with a trusted business registration service like GovDocFiling can help you set up quickly and correctly.

Here’s what sets GovDocFiling apart from other providers:

Fast Turnaround

When speed matters, GovDocFiling delivers. The streamlined process means you can receive your Ohio tax ID in as little as 24 hours. This lets you move forward with bookkeeping and licensing without delays.

Accuracy Guarantee

Filing errors can delay your business plans. GovDocFiling’s expert team double-checks every detail on your Ohio tax ID application, ensuring it’s error-free and fully compliant with the federal and state laws.

All-in-One Service

Beyond Tax IDs, GovDocFiling also offers support for forming an LLC, S-Corp, or other business structures. This makes it a one-stop solution for entrepreneurs seeking to establish their business legally.

Transparent Pricing

You’ll know exactly what you’re paying for from the start. GovDocFiling offers clear and transparent pricing, so there are no surprise fees or hidden costs down the line. This helps you budget more effectively.

Secure Filing

When sharing sensitive information, such as business details or SSNs, security is crucial. GovDocFiling uses safe, encrypted systems to keep your data protected when applying for your Ohio tax ID online.

24/7 Online Access

GovDocFiling’s online platform is available anytime and accessible from any location. You can begin your Ohio tax ID application whenever it’s convenient for you, whether that’s late at night or on a weekend.

FAQ

To apply for an Ohio tax ID, follow these steps:

- Check if your business qualifies for an Ohio tax ID.

- Gather the necessary details

- Choose an application method

- Fill out your tax ID application using the IRS form SS-4

- Submit your Ohio tax ID application

- Receive, store, and use your tax ID

Here are some advantages of applying for an Ohio tax ID:

- Simplifies tax filing

- Let’s you hire employees legally

- Enhances business credibility

- Protects your personal details

Obtaining an Ohio tax ID is free through the IRS, but the process can be confusing. GovDocFiling handles the entire process on your behalf for a small fee.

Yes, an EIN (Employer Identification Number) is a type of federal tax ID issued by the IRS for tax filing. Other types of tax ID numbers include Social Security Numbers (SSNs) and Individual Taxpayer Identification Numbers (ITINs).

You receive your Ohio tax account number when you register with the Ohio Department of Taxation. You can find it on official correspondence, tax returns, or your online business account.

Ready To Get Your Ohio Tax ID?

Don’t spend hours reading through forms and searching for tutorials online, only to make mistakes in your application.

Get your Ohio tax ID filing done quickly and correctly, with GovDocFiling.