Secure Your Georgia Tax ID Hassle-Free with GovDocFiling

Establishing a business in Georgia requires obtaining proper tax ID numbers to ensure legal compliance and smooth operations.

Our guide provides all you need to know about securing your Georgia tax ID.

What Is a Georgia Tax ID?

A Georgia tax ID typically refers to a federal Employer Identification Number (EIN) used by businesses in Georgia. This IRS-issued number is key for compliance with both state and federal tax regulations and for tracking your business taxes.

Georgia doesn’t issue a general-purpose state tax ID or EIN, as it’s issued only at the federal or national level. Still, businesses need to register for specific tax accounts, such as sales and use tax or payroll withholding, at the state level as well.

What are the Different Types of Georgia Tax IDs

Georgia businesses and individuals may need different types of tax identification numbers, depending on their structure or residency status.Here is a comprehensive look at some of the different types of tax IDs.

Employer Identification Number

Your primary Georgia tax ID is a federal EIN issued by the IRS for tax reporting and business identification. Businesses, nonprofits, and trusts use this nine-digit number as their primary identifier for federal tax obligations. This Georgia tax ID is also required when opening a business bank account and performing business activities.

Social Security Number

A Social Security Number (SSN) is a primary personal tax identifier for US citizens and permanent residents. Sole proprietors without employees can use their SSN for both federal and Georgia tax filings. However, most prefer an EIN to an SSN, as it helps them separate their personal and business finances and maintain privacy.

Individual Taxpayer Identification Number

The IRS issues the ITIN to individuals who aren’t eligible for an SSN, yet need a way to file taxes. It doesn’t provide work authorization, immigration status, or eligibility for social security, but it does enable tax compliance and refund claims. Nonresidents, foreign investors, and dependents of US citizens can apply for this Georgia tax ID.

Georgia Sales and Use Tax Number

Businesses selling tangible goods or taxable services must register for a Sales and Use Tax Number via the Georgia Department of Revenue. This Georgia tax ID allows them to collect and remit state sales tax on transactions. It doesn’t expire or require renewal. Businesses must remain compliant with all payment deadlines.

Withholding Tax Account Number

Employers operating in Georgia must obtain a Withholding Tax Account Number. This tax ID is used when withholding state income tax from employee paychecks and remitting it to the Georgia Department of Revenue. The tax account number doesn’t expire, but businesses must file returns to remain in good standing with the state.

Motor Fuel Distributor Number

Companies involved in the sale, transport, or distribution of motor fuel in Georgia must hold a Motor Fuel Distributor Number. While this doesn’t require periodic renewal, holders must maintain an active bond with the state to secure compliance. Failure to comply can put the distributor’s license at risk of suspension or revocation.

Key Benefits of Having a Georgia Tax ID

Obtaining a Georgia tax ID is critical for legal and financial stability. Whether you’re launching an LLC or hiring, your Georgia tax ID unlocks essential benefits.

Ensures Legal Compliance

One of the main reasons for a Georgia tax ID is to ensure legal compliance. Federal law requires most business owners, including LLCs and corporations, to have an Employer Identification Number for filing taxes and meeting regulatory obligations.

In addition, registering your Georgia tax ID through the IRS and coordinating with the Georgia Department of Revenue reduces the risks of penalties. It ensures accurate tax reporting and supports proper accounts management for sales and use tax.

Simplifies Tax Registration

A Georgia tax ID streamlines registration for state-level taxes like sales and use tax, employer withholding, and more. Your federal EIN serves as the foundation for setting up accounts with the Georgia Department of Revenue and initiating filings.

The Georgia Tax Center uses your ID to connect your business to its tax obligations. This centralized system simplifies registration, filing, and compliance, particularly for business owners managing multiple accounts in different locations within the state.

Establishes Business Credibility

Having a Georgia tax ID adds credibility to your operations, signalling legitimacy to vendors, clients, and financial institutions. It shows that your business is registered, compliant, and ready to operate professionally within Georgia’s regulatory structure.

This credibility is crucial for new business owners in Georgia. Whether setting up C-corps or applying for trade credit, your Georgia tax identification number helps establish professional standing with the Department of Revenue and beyond.

Builds Business Credit

Your Georgia tax ID is the foundation for establishing business credit separate from your personal finances. With an EIN, you can open business bank accounts, apply for credit lines, and build a financial profile tied to your company, and not your SSN.

This separation protects your Social Security Number while also strengthening your company’s financial reputation. Over time, consistent use of your Georgia tax ID can help improve creditworthiness, making it easier to secure favorable financing terms.

Protects Personal Privacy

Using a Georgia tax ID instead of your Social Security number helps safeguard your privacy and personal identity or data. This is especially crucial when completing tax forms, applying for licenses, or interacting with vendors and government agencies.

Registering for an EIN helps protect business owners from identity theft by reducing the need to share personal Social Security numbers. It also adds a layer of security and is a proactive step toward supporting future business growth.

Simplifies Hiring & Payroll

If you plan to hire employees, a Georgia tax ID is non-negotiable. It’s required to set up payroll systems, withhold taxes, and comply with federal and state employment rules. Without it, you can’t legally process payroll or report employer-related taxes.

Having a Georgia tax ID streamlines the onboarding process for new employees and ensures proper deductions, including unemployment insurance contributions. It’s essential to maintain accurate records for all employee-related tax obligations.

Why You Should Outsource Your Georgia Tax ID Application?

Applying for a Georgia tax ID involves strict requirements, lengthy forms, and attention to detail that many entrepreneurs find frustrating. Here’s why you should outsource to professionals.

Access to Specialized Expertise

Tax professionals know how to navigate the Georgia tax ID application process with precision. They handle every detail accurately — from classifying your business structure to verifying applicant information. Their expertise helps you avoid common pitfalls like delays, rejections, or unnecessary complications during filing.

Significant Savings in Time & Effort

Preparing a Georgia tax ID application involves gathering documents, reviewing requirements, and carefully filling out forms. Outsourcing frees you from these time-consuming tasks, allowing you to focus on running your business. Experts streamline the process and deliver results more quickly than if you handle it yourself.

Clear Guidance and Support

Filing for a Georgia tax ID often raises questions about eligibility, forms, and supporting documentation. When you outsource, you get access to experts who can answer your questions and provide ongoing guidance through the steps. Their support ensures you meet all requirements with confidence and peace of mind.

Lower Risk of Costly Errors

A single mistake on your Georgia tax ID application can delay approval or trigger compliance issues. Professionals carefully review your forms to ensure they’re accurate. By outsourcing the process, you avoid costly errors and protect your business from unnecessary setbacks.

Compliance with Regulations

Georgia tax ID requirements include both federal and state guidelines, which can be confusing for new business owners. Outsourcing ensures compliance with IRS and Georgia rules. Experts stay current with regulations, helping your business avoid penalties.

Clean and Secure Recordkeeping

Beyond filing your Georgia tax ID, professionals often offer tools for secure recordkeeping. They organize confirmation letters and key documents. They make future filings or audits easier to manage and ensure your records are accurate and accessible.

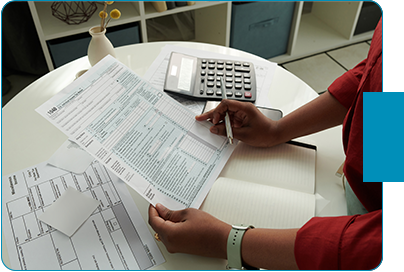

How to Apply for a Georgia Tax ID

Obtaining a Georgia tax ID might seem complex for first-time business owners navigating federal requirements.

To simplify things, follow these straightforward steps.

1. Determine Business Eligibility

Before applying for a Georgia tax ID, verify whether your business qualifies for one. LLCs, corporations, and partnerships are required to obtain an EIN to operate legally in Georgia. It’s crucial for accurate tax reporting and ensuring legal compliance.

Sole proprietors may also need a Georgia tax ID if they plan to hire employees or file excise taxes. Trusts, nonprofits, and estates must secure an EIN to maintain federal and state tax-exempt status. Eligibility hinges on both entity type and tax obligations.

2. Gather Required Information

To apply for a Georgia tax ID, gather key business details including your legal name, trade name (if applicable), and physical address. You’ll also need the SSN, EIN, or ITIN of the responsible party submitting the application on behalf of the business.

Additional details include your business type, formation date, and the primary reason for requesting a Georgia tax ID. Be prepared to disclose your business activities, number of employees, and tax liabilities for accurate processing.

3. Choose Your Filing Method

The fastest way to obtain a Georgia tax ID is by applying online through the IRS website. This method offers immediate processing and confirmation, making it ideal for businesses seeking quick turnaround and digital convenience without delay.

Alternatively, you can apply for a Georgia tax ID by mailing or faxing Form SS-4, especially if your business has unique filing needs. International applicants may also call the IRS helpline. Pro filing services can help ensure accuracy and avoid errors.

4. Complete Your Application

To get your Georgia tax ID, you’ll need to accurately fill out IRS Form SS-4. This form captures key business details like ownership structure, contact information, and entity classification. Mistakes or omissions can delay processing, so review carefully.

Ensure all required fields are filled out, including the responsible party’s SSN or EIN, business start date, and reason for applying. Save a digital or printed copy of your completed Georgia tax ID application and documents for future reference.

5. Submit Your Application

Submitting your EIN application online is the fastest way to receive your Georgia tax ID. The IRS typically issues EINs immediately through its online portal, allowing businesses to complete state registrations and banking setup quickly.

If you choose to fax your application, expect a review period of up to four business days. Mailed submissions may take five weeks or longer. Once approved, store your EIN confirmation letter securely, as it’s your official proof of Georgia tax ID issuance.

6. Register State Accounts

After securing your federal EIN, the next step is registering with the Georgia Tax Center (GTC) for applicable state-level accounts. Depending on business type, you may need a sales and use tax number, payroll withholding account, or other permits.

The Georgia Department of Revenue assigns unique account numbers for each registration. Keep your login credentials and confirmation numbers organized and accessible. These are essential for filing taxes and maintaining your good standing.

7. Use Your Georgia Tax ID

Your Georgia tax ID is a foundational tool for business operations. Use it to open business bank accounts, apply for credit, and establish financial credibility. It’s also required when hiring or applying for licenses, permits, and vendor relationships.

EINs should typically appear on tax forms, invoices, and legal documents to ensure proper tracking and compliance. Keep your Georgia tax ID secure yet accessible, as it will be referenced frequently across payroll, filings, and other business operations.

8. Maintain Ongoing Compliance

After receiving your Georgia tax ID, use it consistently when filing both federal and state tax returns. Track important deadlines for payroll withholding, sales taxes, and annual filings with a reliable calendar to avoid late penalties and compliance issues.

Keep records up to date, especially when ownership, structure, or location changes. Regularly review your GTC accounts and update registrations or renew permits as needed. Doing so ensures your Georgia tax ID profile remains in good standing.

Why Choose GovDocFiling for Your Georgia Tax ID Application

While you can obtain your Georgia tax ID directly from the IRS website for free, GovDocFiling offers unmatched simplicity, guidance, and support.

Its service ensures accuracy, convenience, and peace of mind. Here’s why:

Step-by-Step Guided Filing

GovDocFiling guides you through each step of the EIN application with clear, structured prompts. This minimizes confusion and ensures your Georgia tax ID submission is accurate, complete, and IRS-compliant. It’s ideal for first-time owners or complex business types.

Fast, Secure EIN Delivery

Once the IRS approves your Georgia tax ID, GovDocFiling delivers it securely via email. You won’t need to wait for mailed documents or navigate IRS portals. Instead, GovDocFiling’s encrypted delivery ensures your EIN is protected and easily accessible to you.

Round-the-Clock Availability

The GovDocFiling online EIN application platform is available 24/7, giving you the flexibility to file for your EIN whenever it suits your schedule. Whether it’s late at night or during the weekend, you can complete your Georgia tax ID application without waiting on the IRS.

Real-Time Order Tracking

After submitting your Georgia tax ID application, you can track its status directly and in real-time through GovDocFiling’s secure client portal system. This transparency allows you to monitor progress, receive updates, and know exactly when your tax identification number will be available for immediate business use.

Expert Application Review Process

Professional staff review every Georgia tax ID application before submission to catch potential errors and ensure completeness. This thorough review process significantly reduces the likelihood of IRS rejections, processing delays, or requests for additional information that could slow your business launch.

Third-Party Designee Authorization

As a third-party designee, GovDocFiling can receive your EIN on your behalf by completing the designee section and obtaining your signature. This streamlines the entire process. This official authorization eliminates paperwork complications while ensuring the professional handling of your Georgia tax ID application.

FAQ

A Georgia tax ID typically refers to the federal Employer Identification Number (EIN) assigned by the IRS for businesses operating in Georgia.

Georgia doesn’t issue its own general business tax ID. However, companies may need additional state-specific registration numbers through the Georgia Department of Revenue for sales tax, payroll withholding, or other compliance requirements.

The process for obtaining a Georgia tax ID involves several important steps:

- Determine your eligibility

- Collect required details

- Choose a filing method

- Complete the application

- Submit your application

- Register state accounts

- Use your tax ID

- Maintain ongoing compliance

Yes, you can apply for your Georgia tax ID online through the IRS website or professional services like GovDocFiling.

Processing times for your Georgia tax identification number vary depending on the application method. Online IRS applications or professional services, such as GovDocFiling, are usually approved within minutes. Faxed applications take about four business days; mailed ones can take four to five weeks to process.

A Georgia tax ID (EIN) is free if obtained directly through the IRS website. However, many business owners choose a professional service like GovDocFiling for the added convenience and support.

Ready to Begin Your Georgia Tax ID Application?

Applying for a Georgia tax ID is simple with GovDocFiling. Available 24/7, we offer step-by-step guidance plus live support to answer your questions.

No matter your business type, enjoy a quick and accurate application process.