What is a tax ID number?

It’s essentially the business equivalent of a Social Security Number (SSN).

Just as every person born in the United States is assigned an SSN at birth, businesses are assigned a Tax ID number by the IRS when they are formed.

This number is used by the Social Security Administration (SSA) and the Internal Revenue Service (IRS) to track income and determine social security benefits for individuals with an SSN.

The SSN follows you throughout your life and is required for certain activities like applying for federal loans, opening bank accounts, and filing tax returns. Similarly, a business’s Tax ID number is used for tax and operational purposes.

The ABCs of Tax IDs

Perhaps you’ve heard of a Tax ID Number by a different name. Employer Identification Number (EIN), Federal Employer Identification Number (FEIN) and Federal Tax Identification Number (Federal TIN) all refer to the same nine-digit number — with the format 12-3456789 — provided by the IRS to new businesses.

A federal Tax ID number is necessary when applying for a business license, opening a business bank account and/or establishing a line of credit, hiring employees, filing tax reports/returns/payments, and more.

Taxpayer Identification Number (TIN) vs. Employer Identification Number (EIN)

A TIN (Tax Identification Number) is a broad term that describes any form of identification number for a taxpayer. An Employer Identification Number (EIN) is a special type of TIN that identifies a business for tax reporting purposes.

These terms are often used interchangeably, and when someone requests to see the tax ID for your business, they are simply referring to your EIN.

Besides EIN, TIN is a generic descriptor for other tax IDs used on a tax form, including but not limited to:

- SSN (Social Security Number)

- ITIN (Individual Tax Identification Number)

- ATIN (Adoption Tax Identification Number)

- PTIN (Preparer Tax Identification Number)

FEIN vs. EIN

FEIN stands for Federal Employer Identification Number. It’s similar to the EIN, only that it’s offered by the federal government and not the state.

FEIN also gives users access to the digital federal tax system where they can easily make their tax payments online or over the phone.

Also Read:

- What Does it Mean to Have a Tax ID Number?

- What Are the Differences Between a Federal and a State Tax ID Number?

Do you need a Tax ID?

Not every new business needs a Tax ID number. For example, a single business owner can choose to conduct business or provide services as an individual, in which case taxes are associated with his or her SSN instead of an EIN.

However, you will need to apply for a Tax ID if any of the following are true:

- You need to open a business bank account or want to start a business line of credit

- You have hired or will hire employees, including household employees

- You have formed or created a Trust, pension plan, Corporation or Partnership

- You have formed an LLC with employees or a Sole Proprietorship with excise tax return or pension filing needs

- You wish to obtain a business license or building permits, pay state or local taxes, or issue 1099 forms to independent contractors

- You changed the legal character or ownership of your organization (i.e., you incorporate a Sole Proprietorship or form a Partnership)

- You are representing an estate that operates a business after the owner’s death

- Your business has a Keogh plan (a tax-deferred pension plan available to self-employed individuals or unincorporated businesses for retirement purposes)

Even if you can use your SSN in place of an EIN, you may not want to. When clients are asked to pay an invoice, they will need information from you — including an SSN — to make payments.

Sending such sensitive information to clients may increase your chances of identity theft. For the sake of privacy, creating a Tax ID number for your business may be beneficial in the long run.

Additionally, to create a business bank account, you will need a Tax ID/EIN. Having a business bank account is ideal to separate your business and personal finances, income, and expenses.

Documentation is very important for all businesses, and having an EIN and a bank account helps to organize, document and operate in compliance with tax and government regulations.

Also Read:

- Low-Cost Online Businesses for Beginners to Start

- Financial Challenges That Small Businesses Face

Which Business Entities Need EIN?

Certain businesses are required to have an EIN by the IRS as part of their reporting and operating requirements. Without this crucial ID, the business cannot operate legally in the state and could face heavy fines for non-compliance.

But before starting an application, you need to understand if you need an EIN or not. Remember, not all businesses are required to get an employer identifier number. But even if you’re not required to have an EIN, you may want to get one.

Let’s go through the details of what is a tax ID number to see which entities need an EIN.

Let’s go through the details of what is a tax ID to see which entities need an EIN.

Independent Contractors and Freelancers

Independent contractors and freelancers don’t need an EIN. They can simply report their earnings and file taxes with their SSN.

Sole Proprietorship

If your business is set up as a sole proprietorship and you don’t have any employees, then you don’t need an Employer Identifier Number.

But if your Sole Proprietorship has employees, then you’re required to know what is a tax ID number and obtain an EIN for your business.

Besides allowing you to hire employees, an EIN allows you to open a business bank account so you can separate your personal and business funds.

This makes it easy to build business credit and obtain a loan to grow your business. Additionally, EIN reduces the risk of identity theft since you will not be sharing your SSN with your business clients.

Single-member LLC

If your business is structured as a single-member LLC and you don’t have any employees, then you’re not required to get an Employer Identification Number.

However, single-member LLCs with employees are required to have an EIN for tax reporting purposes.

They also need the employer identifier number to hire employees and open a bank account. This helps the organization maintain its corporate veil and build business credibility.

Partnerships or Multi-member LLC

Businesses established as a partnership or multi-member LLC must get an EIN because the business must file a partnership return and provide the members of the LLC with their K-1s.

Corporations

If your business has an S-Corporation tax structure, you’re required to obtain an EIN so you can pay taxes.

C-Corps are also viewed as a separate business entity from the owner and need an Employer Identification Number for reporting their taxes.

Nonprofit Organizations

Nonprofit organizations need to apply for a nonprofit organization EIN to enjoy tax-exempt status.

Trusts

Trusts need an employer ID when classified as irrevocable. An irrevocable trust is a separate legal entity that cannot be changed by the grantor. As such, these trusts should get a tax ID, which is the EIN.

Also Read:

- What Are the Benefits of Having Multiple LLCs for Your Business?

- Steps to Starting an LLC (Limited Liability Company)

Applying for a Tax ID

If you have determined that you need a Tax ID, here is the process:

1. Decide which entity type best fits your business structure. This step is critical, as it determines the legal classification of your company, how your profits are taxed, and the type of bank accounts you can open. If you are unsure of which entity type is right for you, you can take a quick survey.

2. Fill out our online EIN Application (SS-4 form) and submit it with a one-time filing fee for processing. The IRS requires applicants to provide the following information when filling the form:

- The name of the responsible party with their individual taxpayer identification number

- The type of entity being formed

- Reasons for applying

- The date the company was started or acquired

- The main area of operation for the business

3. You will receive the EIN with documentation from the IRS to your inbox the same day you submit the Tax ID application on govdocfiling.com.

It’s important to note that it can take up to two weeks for your Tax ID number to become recognized by official IRS records. You may have to wait until you can use your EIN to file an electronic tax return, make an e-payment or pass an IRS Taxpayer Identification Number (TIN) matching program.

Please also note that different banks have different requirements and some may request the official letter from the IRS, which is sent to the address provided in the online Tax ID application. This can take up to four weeks to arrive.

Once you have your federal Tax ID, you will need to look into state government requirements. Every state is different, so you will need to determine the filing requirements for your state.

You may need to get a State Tax ID number if you are selling tangible goods. If you are creating an LLC or a Corporation, it is required to file your Articles of Organization (for LLCs) or Articles of Incorporation with your state.

Important Things to Know When Applying for EIN

There are a few things you need to note when applying for an EIN. They include:

Responsible Party

Besides knowing what a tax ID number is, the IRS requires EIN applicants to state the name and provide the individual taxpayer identification number of the officer, general partner, owner, trustor, or true principal of the business.

This individual is known as the responsible party and he or she is responsible for the management and control of the applicant entity. The responsible party is also in charge of the funds and assets of the company applying for the tax ID.

The IRS requires that the responsible party be a natural person. It cannot be a government entity or another business entity.

Third Party Authorization

When applying for an EIN, applicants need to complete the third party authorization section. For the third party authorization to be valid, the taxpayer should sign the form as well.

After completing and signing the form, the taxpayer should fax or mail the form to an IRS service center. The third party authorization only applies to newly assigned EINs. The authority ends when the EIN is released.

Tax Exemption Status

Before applying for your EIN, ensure your company is registered legally. The IRS assumes that all organizations applying for tax ID know what is a tax ID number and are legally formed.

You should also note that all organizations that are exempt from federal income tax under IRS 501(a) get their tax exemption status withdrawn if their annual tax returns are not filled for three years.

If this applies to your organization, take note that the countdown to this 3-year period starts when you apply for your tax ID.

Also Read:

Limitation on Issuance of EIN

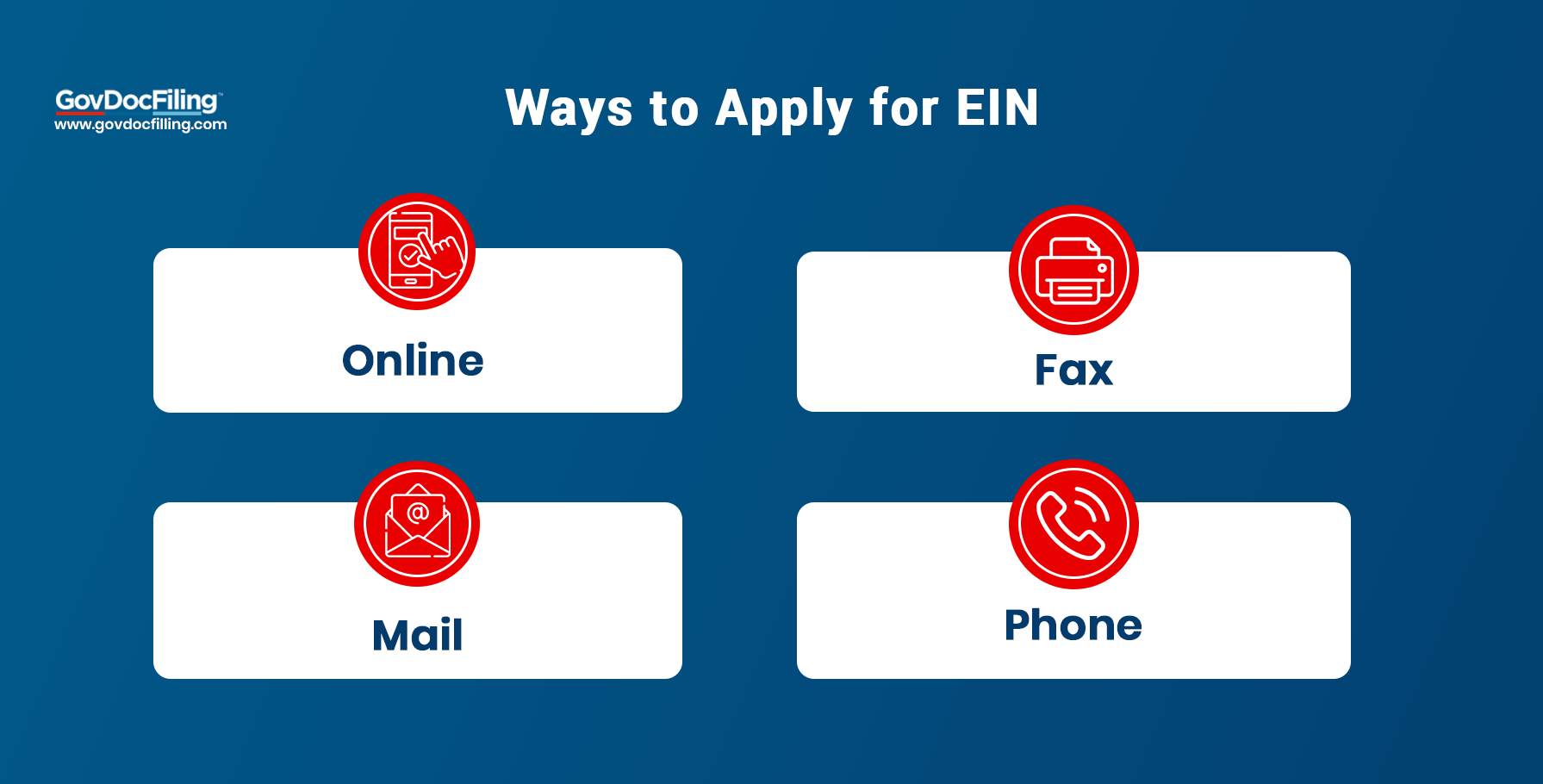

The IRS now limits the issuance of EIN to one ID per one responsible party per day. The limitation applies irrespective of the method used to apply for the EIN (online, mail, fax, or telephone).

According to the IRS, this limitation is in place to bring fairness to the entire process.

How Long Does It Take to Receive Your EIN?

The amount of time it takes to receive your EIN depends on the method of application used. The processing time for each of these methods is different as you will see below.

Applying for EIN Online

When you apply for your EIN online, the ID is issued almost immediately.

Applying for EIN by Fax

EIN applications by fax are processed in approximately four business days.

Applying for EIN by Mail

When you apply for your EIN by mail, your ID will be processed in approximately four weeks.

Applying for EIN by Telephone

Applying by phone is easy and your tax ID number could be issued almost immediately if everything progresses smoothly. The IRS agent who handles your EIN application may ask you to fax or mail your form SS-4 not more than 24 hours after the phone call.

Also Read:

- 10 Most Common Startup Mistakes You Need to Avoid

- Business Startup Checklist: What New Businesses Need

Do I Need a New EIN?

Businesses generally need a new EIN if the business structure or ownership has changed. Changing a business name doesn’t necessarily warrant the application of a new EIN.

Business owners can simply follow the IRS procedure of changing their business name and continue using the same EIN.

Find the structure of your business entity below to see if any changes in your business require you to get a new EIN.

Sole Proprietorship

As a sole proprietor, you need a new EIN if the following statements are true:

- You have incorporated the business

- You have bought or inherited an established business that you want to operate as a Sole Proprietorship

- You have brought in a partner for the Sole Proprietorship and want to run it as a Partnership

- Your business is currently going through bankruptcy proceedings

However, you don’t need a new tax ID number if any of the following are true:

- You have more than one business

- You have formally changed the name of your business

- You are moving your business to a new location

Also Read:

- Tax Benefits of an LLC for Your Rental Property

- Difference Between Copyright and Trademark: Which One Is Right for Your Business

Corporations

You will need a new Employer Identification Number for your Corporation if the following are true:

- You’re issued with a new charter by the Secretary of State

- You have downgraded your Corporation to a Partnership or Sole Proprietorship

- You have established a new Corporation after a statutory merger

- You have become a statutory of another Corporation

- Your state requires it

However, you don’t need to get a new EIN for your Corporation if the following are true:

- You’re part of an existing Corporation

- The Corporation is declared bankrupt

- You have changed the name of your Corporation

- You choose to have your Corporation taxed as an S-Corp

- The surviving Corporation after a Corporation merger chooses to use the existing EIN

Partnerships

You’ll have to get a new EIN if the following statements are true:

- You decide to incorporate the Partnership

- One partner takes over the Partnership and opts to operate it as a Sole Proprietorship

However, you don’t need a new tax ID for a Partnership if the following are true:

- You choose to change the name of the Partnership

- You changed the location of the Partnership

- You terminated the Partnership and created a new Partnership under IRS rules

- More than 50% of the Partnership ownership changes within 12 months

Limited Liability Company (LLC)

A business registered as an LLC may have to acquire a new tax ID number if the following are true:

- A new LLC with multiple owners is created under state law

- A new LLC with a single owner is created under the state law and elects to be taxed as an S-Corp

However, you don’t need a new EIN for your LLC if the following are true:

- An existing Partnership converts to an LLC that’s classified as a Partnership

- The LLC changes its name or location

- An LLC with an EIN elects to be taxed as an S-Corp

- A single-member LLC that’s formed legally under the state with no employees and elects to be taxed as an S-Corp. Note that you can obtain an EIN for banking purposes, but are not required to get one for tax reporting.

Estates

Estates should obtain a new EIN if the following are true:

- The estate is converted to a trust using funds from the estate

- You’re in-charge of an estate that operates a business after the death of the owner

However, an estate doesn’t need a new EIN if the following are true:

- The executor or administrator of the estate changes the address or name

Trust

A trust needs to get a new EIN when the following happens:

- The trust is converted into an estate

- You terminate a living trust by moving its assets to a residual trust

- A trust gets many grantors

However, there’s no need to get a new tax ID if any of the statements below are true:

- The grantor or beneficiary changes their name or address

- The trustee is changed

Also Read:

- How to Start Your Freelance Business: A Quick Guide

- Partnership vs S Corp: Everything You Need to Know

Benefits of Having a Federal Tax Identification Number

Once you’re done obtaining your tax ID number from the IRS, you can unlock a range of opportunities for your business. Here’s how:

- Open a bank account – Banks require individuals to produce an EIN when opening a business bank account. Besides the EIN, you may also have to show your incorporation documents or “Doing Business As” certificate to prove your business has been registered formally.

- Apply for a business license in your state – Many states require business owners to know what a tax ID number is and produce their EIN to get a license that permits them to conduct business in the state.

- File a tax return by mail – You need an EIN to file your federal income tax return by mail. Bear in mind that it may take the IRS up to eight weeks to process your tax return when you use this option.

- Take a business loan – Most banks require business owners to have a business account to apply for a loan. And as we have already established, you need an EIN to open a business bank account.

- Hire employees – You cannot hire employees for your business without EIN. You also need an EIN to set up your payroll system.

- Boost credibility – Tax ID sets you apart as a serious and responsible individual who’s committed to the business.

Common Mistakes When Applying for a Tax ID

The application process for a tax ID number can be straightforward, but several common mistakes that can complicate the process:

- Misunderstanding tax purposes – Some applicants apply for an EIN without fully understanding how it will be used for tax purposes. Make sure you know whether your business requires an EIN or another type of taxpayer identification number.

- Choosing the wrong business structure – Selecting the incorrect business structure during the application process can lead to issues down the line. Ensure you correctly identify your entity type, whether it’s a sole proprietorship, partnership, LLC, or corporation, when filing your Form SS-4.

- Applying before business formation – Obtaining an EIN before your LLC is officially formed can lead to rejection. The IRS requires the approved legal name and formation date of your business. Always register your LLC with the state before applying for an EIN to ensure a smooth process.

- Providing incorrect information – Errors in key details such as your business address, email address, or Social Security Number (SSN) can delay processing. You want to double-check all entries before submitting your application on the IRS website.

- Overlooking the responsible party requirement – Failing to correctly identify the responsible party for the business with their name and taxpayer identification number (ITIN, SSN, or EIN) can cause delays. This person should be an individual, not an entity, with control over the business.

So, what should you do if you make a mistake on your EIN application?

- Contact the IRS promptly to rectify the information on your Form SS-4. Send a letter detailing the necessary changes, including all correct business information.

- Be prepared for a processing time of up to 30 days for the IRS to update your information in their database.

- If your initial EIN application is rejected, carefully review your records, make the required changes, and resubmit your application.

How Do I Retrieve a Lost EIN?

Losing your EIN can be very frustrating. When that happens, there’s no need to panic. Use the following actions to locate your tax ID.

- The IRS gives you a confirmation of your application when you apply for an EIN. Locate this notice to find your tax ID.

- If you’ve used your EIN to open a business bank account, ask the bank to help you find your EIN.

- Locate a previous federal income tax return to find your EIN.

Also Read:

- How to Start a Retail Business: Everything You Need to Know

- Sole Proprietorship vs S Corp: Pros & Cons Of Each

FAQs

Q1. Is a tax ID number the same as SSN?

A, A tax ID is a broad term that describes any form of identification number. SSN is an identification number for individuals in the US. As such, it is also defined as a tax ID.

Q2. How do I find my tax ID number?

A, If you have lost your EIN, you can use the following actions to locate your tax ID:

- Locate the confirmation IRS sent you when you applied for your tax ID number

- Ask your bank to help you retrieve your EIN if you had used it to open a business bank account

- Locate a previous tax return to find your EIN

Q3. What is considered a tax ID?

A, A tax ID is a nine-digit number that identifies an individual or a business with the IRS. With this ID, you’re required to pay taxes and report your earnings to the IRS.

Q4. Is a tax ID the same as EIN?

A, A tax ID is a general term that describes any form of tax identification number. An Employer Identification Number (EIN) is a special type of tax ID that identifies a business for tax reporting purposes.

Q5. How do I know if I need EIN?

A, You need an EIN if you want to hire employees for your business. You will also need one to open a business bank account and build business credit.

Wrapping Up

GovDocFiling removes the angst and aggravation of filing government documents, helping you avoid common mistakes to get things done right the first time and move forward with your business needs.

By now, you have the answer to the question, “What is a tax ID number?” So, if you’re ready to get your business started, we’re ready to file the paperwork. Apply now!

About the author

From selling flowers door-to-door at hair salons when he was 16 to starting his own auto detailing business, Brett Shapiro has had an entrepreneurial spirit since he was young. After earning a Bachelor of Arts degree in Global and International Studies from the University of California, Santa Barbara, and years traveling the world planning and executing cause marketing events, Brett decided to test out his entrepreneurial chops with his own medical supply distribution company.

During the formation of this business, Brett made a handful of simple, avoidable mistakes due to lack of experience and guidance. It was then that Brett realized there was a real, consistent need for a company to support businesses as they start, build and grow. He set his sights on creating Easy Doc Filing — an honest, transparent and simple resource center that takes care of the mundane, yet critical, formation documentation. Brett continues to lead Easy Doc Filing in developing services and partnerships that support and encourage entrepreneurship across all industries.